Driving a Healthy Economy

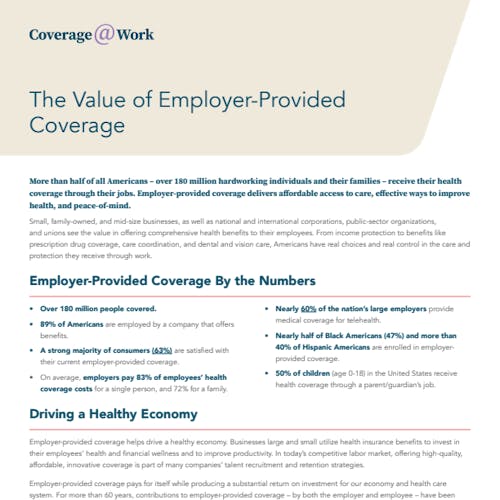

Employer-provided coverage helps drive a healthy economy. Businesses large and small utilize health insurance benefits to invest in their employees’ health and financial wellness and to improve productivity. In today’s competitive labor market, offering high-quality, affordable, innovative coverage is part of many companies’ talent recruitment and retention strategies.

Employer-provided coverage pays for itself while producing a substantial return on investment for our economy and health care system. For more than 60 years, contributions to employer-provided coverage – by both the employer and employee – have been excluded from taxable income.

According to a recent report from Avalere, employers with 100 or more workers see a 47% return on investment for offering health coverage, in the form of increased productivity and other factors. In a competitive labor market, offering high-quality, affordable, innovative coverage is part of many companies’ talent recruitment and retention strategies.

Avalere’s research estimated that employers would see a return of $275.6 billion in improved productivity in 2022, which is expected to jump to $346.6 billion in 2026. Avalere also projects $119.2 billion from tax benefits in 2022, expected to increase to $139.7 billion by 2026. The employers also benefited from recruitment and retention of talent, as well as reductions in short- and long-term disability claims.

The direct benefits and federal spending offsets of employer-provided coverage result in an annual net social impact of $1.5 trillion, driven by increased labor participation, business formation, increased health coverage, and reduced federal health subsidies. Each dollar of federal expenditure – the tax revenue foregone for employer-provided coverage – yields approximately $5.34 in benefits for covered employees and their families.

Coverage During Crises That Adapts to Changing Needs

When unprecedented challenges arise, employers and health insurance providers were able to reach the more than 180 million Americans with employer-provided coverage and adapt to crises while meeting health care needs. As evidenced with quick responses during the COVID-19 pandemic, employers and health insurance providers worked together to keep millions of Americans covered even when furloughed, supporting access to care throughout the pandemic with rapid plan modifications like increased telehealth and delivering access to vaccinations.

More than half of employees saw the telehealth and mental health services offered through their employer-provided coverage as more valuable than before the pandemic.

In fact, 68% of consumers consider it important for plans to cover telehealth services, and 73% believe it’s important for the

federal government to maintain the pandemic-era telehealth flexibilities for patients.

Employer-provided coverage continues to be nimble in order to meet the needs of Americans, including the need for telehealth. Nearly 60% of the nation’s large employers (500 or more employees) provide medical coverage for telehealth, and access to these employer-offered services has more than doubled in recent years.

Health insurance providers partnered with technology leaders and innovative doctors with the goal of expanding care to rural Americans via telehealth options. These solutions are not only cutting-edge, but convenient and cost-effective for Americans.